Should You Sell Tesla Stock Amid Growing Concerns Around Elon Musk’s Leadership?

Tesla’s stock has been facing some serious turbulence lately, raising the question: Is it time to sell? With a mix of concerns surrounding CEO Elon Musk and Tesla’s recent performance, investors are asking if the risk is worth it.

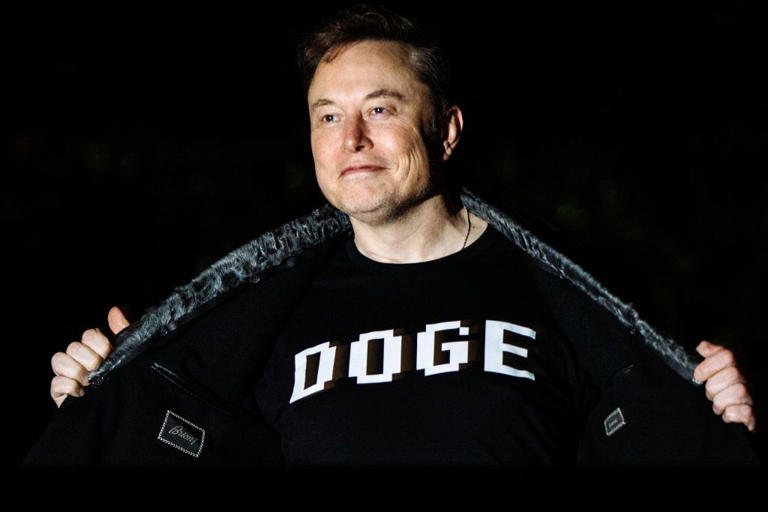

Musk, known for juggling multiple projects like electric vehicles and space rockets, has found himself at the center of several distractions, including controversial statements and issues with Tesla’s performance. This has left many questioning if his focus on other ventures like SpaceX and cryptocurrency is hurting Tesla’s bottom line.

Recently, Tesla’s stock experienced a major dip, with its value falling significantly. Although some analysts, like Dan Ives from Wedbush, still see potential for a rally, others, like Joseph Spak from UBS, have a more cautious outlook. Spak lowered his 12-month target for Tesla, citing weak sales figures in key markets like the U.S., Europe, and China.

Despite these concerns, Ives remains optimistic, predicting that Tesla’s future innovations, including AI and humanoid robots, will drive growth in the long term. However, it’s clear that Tesla investors are facing a tough decision: Hold on and ride out the storm, or sell while there’s still time?

The uncertainty has even led to technical analysts like Frank Cappelleri suggesting that Tesla’s price movements are unpredictable, and it might be wise to stay on the sidelines for now. Ultimately, whether you sell or hold onto Tesla shares depends on your investment goals, risk tolerance, and belief in Musk’s long-term vision for the company.